How to Make a CPN Step by Step PDF 2023

A credit privacy number (CPN) is a nine-digit identification number that can be used in place of a social security number (SSN). While a CPN is not an SSN and cannot be used for employment purposes, it can be used to apply for credit. In order to obtain a CPN, you must first have a credit report.

How to Get a CPN Number for Free 2023

When your chances of obtaining a loan seem very low, and applications get declined, it’s normal to wish you could wipe all that bad history away and get a fresh start. This is the sole reason people seeking loans with a bad credit score are the most targeted by agencies claiming to sell/help acquire a Credit Privacy Number (CPN).

A CPN is a nine-digit number similar to a Social Security Number (SSN). And as its name suggests, it’s meant to protect your credit number and information tied to your account. However, there is a widespread misconception on what you can use a CPN for, with many thinking it can substitute for their SSN when securing a credit.

While credit information protection is legal, it’s worth noting that it’s not issued as a number and isn’t a direct substitute for an SSN. The federal legislation only permits people to use CPNs for business financial reporting while protecting information about their SSAN that they don’t want to be revealed.

Also, individuals who get a CPN are solely liable for any debt that they incur while using it. In simple terms, even though dubious agencies will position CPN as a solution for bad credit, it won’t help you secure a loan as it serves a different purpose.

If you’re keen about getting a loan, there are ways to repair your credit history instead of cloaking yourself under a CPN. Instead, spend the money you would have wasted on a CPN scam on fixing your bad credit history. Here’s how to go about it:

Helpful Resource:

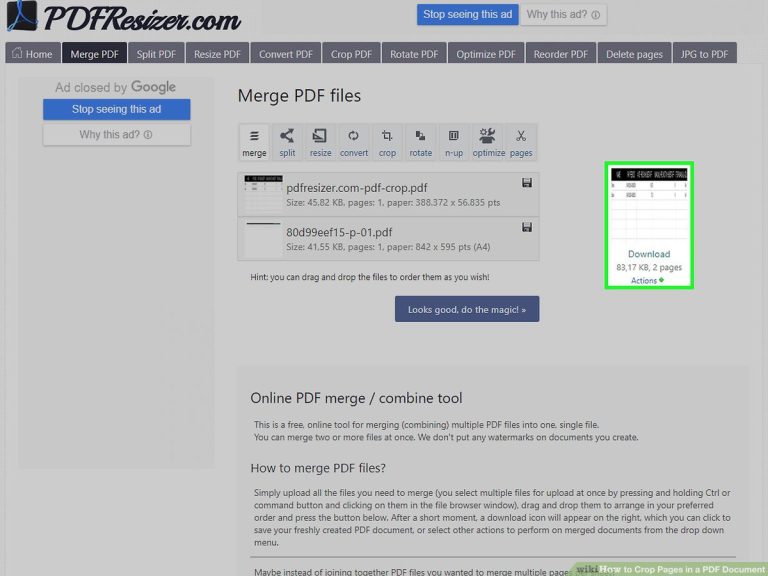

How to Make a CPN Step by Step pdf

how to make a cpn step by stepKeep a Low Debt-to-Credit Ratio

This ratio is derived from how much of your available credit you’re using, calculated alongside your credit history. This gives you your credit score, and you shouldn’t use more than 30% of your available credit if you want to attain an optimal score.

Make Your Payments on Time

You probably already know this, but the benefits of early payments on your credit score cannot be overemphasized. Even if you can only repay parts of the loan and not in full, doing so on time will give you a slight edge.

You also want to ensure that you set reminders on a calendar for repayment of each loan. Repaying all your loans at once is not always feasible, but you can dial up your loan company and request them to modify your date.

Don’t Apply for Different Loans at the Same Time

Applying for too many loans within a given period will signal to credit scoring models such as FICO that you’re applying rapidly because you have financial issues. That can be detrimental to your credit score, and hard inquiries on your credit history are the last thing you need in this period.

Leave Old Credit Accounts Active

You’d be surprised how maintaining old credit accounts can positively impact your credit score. It indicates that you’ve had the credit for a long time and will eventually increase your score.

Register with a Professional Credit Repair Company

If you don’t have the patience or financial tactics to fix your bad credit score, your best bet is to register with a professional credit repair company. Whatever company you register with will assess your credit and proffer an ideal solution to get it back up.

It’s better to invest in measures such as this than buy a CPN, which is illegal and a scam.

The Bottom Line

As at the time of writing this article, no government agency issues CPNs as an SSN-looking alternative. If any company offers to sell you a CPN, keep in mind that you’re only buying the SSN of a deceased or old person that’s not in use, which is a punishable offense under the law.