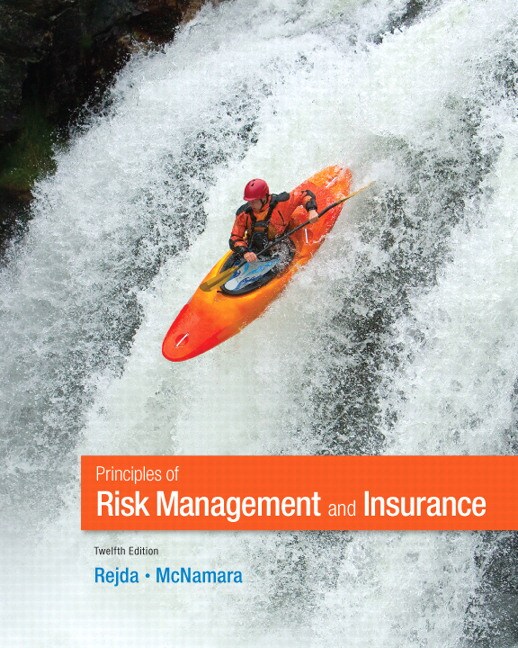

principles of risk management and insurance

As a business owner, you must protect your company from potential risks. One way to do this is by purchasing insurance. Insurance will financially protect your business in the event of an unexpected loss. But, insurance is not a one-size-fits-all product. You must carefully select the right type and amount of insurance for your business. The principles of risk management and insurance will help you make the best choices for your company.

Credit: www.pearson.com

What are the principles of risk management

There are four basic principles of risk management and insurance that are important to understand. They are: 1. Risk management is the process of identifying, assessing and managing risks. 2. Insurance is a contract between two parties whereby one party agrees to pay the other party for losses that may occur. 3. Risk management and insurance are two different but complementary activities. 4. The goal of risk management is to protect the value of an organization, while the goal of insurance is to transfer the risk of loss to another party. Risk management is the process of identifying, assessing and managing risks. The goal of risk management is to protect the value of an organization by minimizing the impact of losses. Risk management includes activities such as identifying risks, analyzing risks and developing plans to mitigate risks. Insurance is a contract between two parties whereby one party agrees to pay the other party for losses that may occur.

principles of risk management and insurance pdf

Conclusion

There are four main principles of risk management and insurance: risk avoidance, risk reduction, risk retention, and risk transfer. Risk avoidance is the simplest and most effective way to manage risk. By avoiding exposure to potential risks, we can eliminate the possibility of experiencing a loss. Risk reduction is another way to manage risk. By taking steps to reduce the severity of a potential loss, we can minimize the impact of an adverse event. Risk retention is a third way to manage risk. By retaining some portion of the risk, we can spread the impact of a loss across a larger number of people or organizations. Risk transfer is the fourth and final way to manage risk. By transferring the risk to another party, we can shift the financial burden of a loss from ourselves to someone else.